Bankassurance

Seamless Insurance through Trusted Banking Partners

What is Bancassurance

Bancassurance is a collaborative model where banks distribute insurance products alongside their financial services to their customers. Bancassurance generally means selling insurance products under the same roof of a bank. It is a complete and combined financial solution for an individual. The bancassurance channel can be digital or direct.

The Insurance Development and Regulatory Authority (IDRA) issued a circular outlining the appointment of corporate agents by commercial banks for partnering with insurance companies. Under the guideline titled ‘Corporate Agent (Bancassurance) Guideline – 2023’ allows banks to directly sell insurance products to their customers. Banks can sell the following non-life products:

Under Corporate Agent (Bancassurance) Guidelines 2023 the Insurance Development and Regulatory Authority (IDRA) issued License to The Premier Bank PLC and The Midland Bank PLC to operate Bancassurance Business with Pragati Insurance Limited. This License is only applicable to conduct Bancassurance business/marketing of specific insurance products under prescribed terms and conditions.

The Process

The settlement of claims shall be the responsibility of the insurer and shall be obliged under the following arrangements:

01.

Claim Support from Bank

The bank helps the insured or nominee(s) as a facilitator throughout the claim process.

02.

Clear Communication Guide

Claim communication steps are defined in the agreement. The bank informs claimants how to reach the insurer.

03.

Assistance with Documents

At the insurer’s request, the bank helps collect required documents and info for claim processing.

04.

Direct Claim Settlement

The insurer settles the claim directly with the insured or nominee(s), while keeping the bank informed.

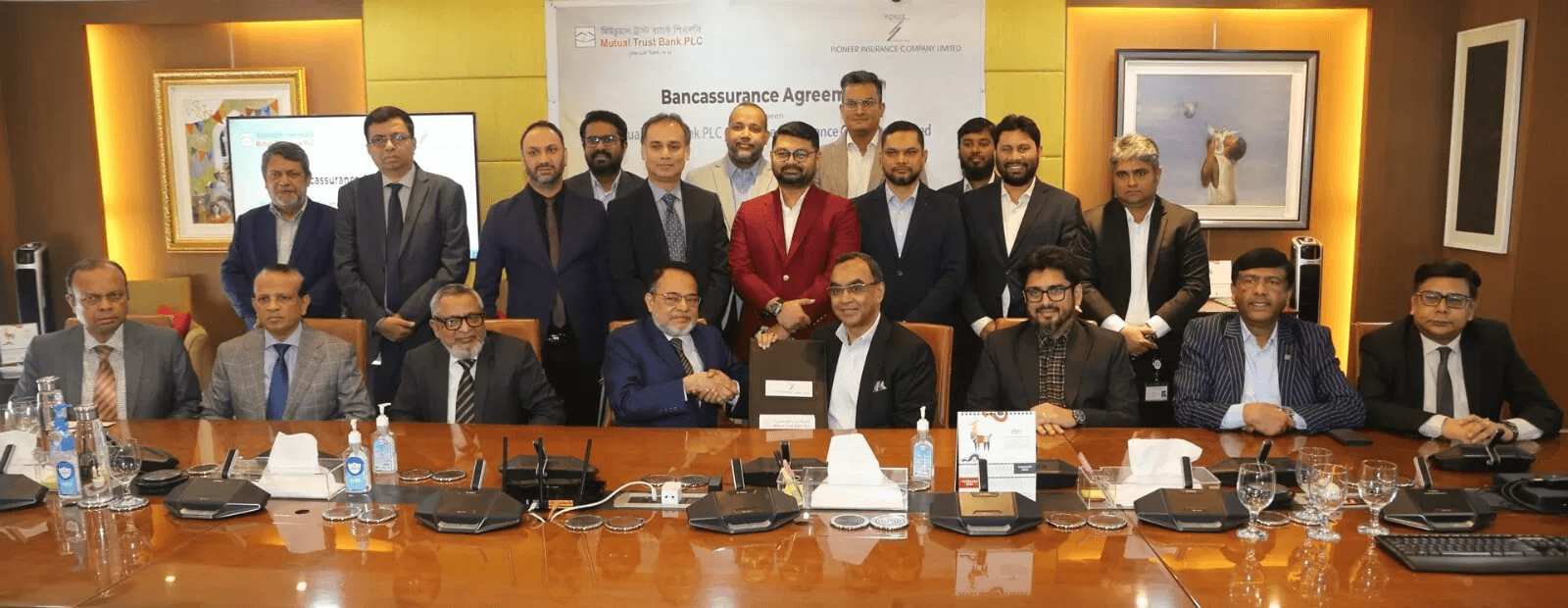

City Bank

City Bank has signed an agreement with Pioneer Insurance PLC to sell non-life insurance policies under Bancassurance. The signing took place on April 30, 2024, at City Bank’s Head Office, in line with the Bancassurance Guidelines of Bangladesh Bank and IDRA.

Mashrur Arefin, MD & CEO of City Bank, and Syed Shahriyar Ahsan, CEO of Pioneer Insurance PLC, signed the agreement on behalf of their organizations. Senior officials from both institutions were also present at the ceremony.

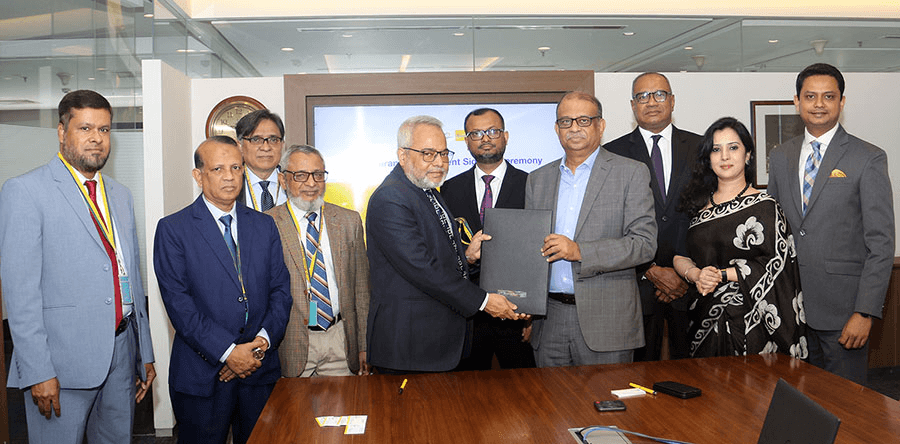

Eastern Bank PLC

Eastern Bank PLC (EBL) has signed a Bancassurance agreement with Pioneer Insurance PLC, enabling EBL customers to access Pioneer’s insurance products directly through the bank under the Bancassurance Guidelines of Bangladesh Bank and IDRA.

Ali Reza Iftekhar, MD & CEO of EBL, and Syed Shahriyar Ahsan, CEO of Pioneer Insurance PLC, signed the agreement at a ceremony held at EBL’s head office in Dhaka. Senior officials from both organizations were also present.

Why Bancassurance

The government of Bangladesh issued a notification affirming that “Insurance” is a permissible business activity for banks, as outlined in Section 7 (1) (la) of the Banking Company Act, 1991

Convenience

Get insurance and banking services in one place.

Trust

Purchase coverage through customers preferred banks—an institution you already know and trust.

Speed & Simplicity

Faster processing and seamless integration with customer’s financial activities.